The Intellectual Property (IP) Box Regime in Cyprus

Intellectual Property (IP) can be a very valuable asset of an organization. If IP is significant to your business, choosing the right location for the centralization and management of the IP is a key strategic business decision. The greatest location to establish an IP structure is one that can serve the organization’s business strategies and model, safeguard and protect its IP, taking into account possible tax implications.

Cyprus offers an efficient IP tax regime coupled with the protection afforded by EU Member States and by the signatories of all major IP treaties and protocols. The amended IP box scheme and the revised legislation have been effective since July 2016.

In other words, under certain circumstances the 80% of the qualifying profits may be considered as non-taxable. This article will include information in relation to the IP regime, how this works and how it may be of assistance to your organization.

The new regime applies to intangible assets developed after 1 July 2016, owned by a Cyprus entity, registered in its name either in Cyprus or abroad.

Qualifying intangible assets

In order for an IP to benefit from the applicable IP regime it must be placed as a Qualifying Intangible asset. Previously, there was a wide definition on qualifying assets and included copyrights, patented inventions, trademarks and service marks and designs or models applicable to products.

Today, the new regime narrows the range of assets that qualify. Qualifying intangible assets now refers to an asset that was acquired, developed or exploited by a person to further a business (excluding intellectual property associated to marketing), which relates to research and development activities, and includes intangible assets for which only economic ownership exists.

These assets include patents (as defined in the Patents Law) such as, computer software and other IP assets that are non-obvious, useful and novel. The person exploiting the asset must not generate annual gross revenue over €7.5 million, and if the person is a group company, the group’s revenue must not exceed €50 million.

Those not treated as qualifying intangible assets include: business names, brands, trademarks, rights to public presence, image rights and other intellectual property rights.

Qualifying Profits

“Qualifying profits” is defined as the percentage of the overall income coming from the qualifying asset that corresponds to the part of the qualifying expenditure, as well as the uplift expenditure across the total expenditure incurred for the qualifying intangible asset.

The formula used to derive to the Qualifying Profit amount is:

Qualifying Profit = Overall Income × ((Qualifying Expenditure + Uplift Expenditure) / Overall Expenditure)

Overall Income

The 80% of the overall income derived from the qualifying intangible asset is treated as a deductive expense. For each tax year, the taxpayer may elect to waive this allowance, either in part or in whole.

Overall income includes the following:

- Royalties or other amounts from the use of qualifying intangible asset.

- Any amount for license fees from the operation of a qualifying intangible asset.

- Any amount received from insurance or as compensation from the qualifying intangible asset.

- Capital gains and any other income arising from the sale of a qualifying intangible asset.

- Embedded income of the qualifying intangible asset arising from the sale of products or services or from the use of procedures that are directly related to the assets

To calculate the overall income, direct costs include:

- All costs incurred, either directly or indirectly, wholly and exclusive for the purpose of earning the income from qualifying intangible assets.

- The amortization of the cost of the assets.

- Notional interest on equity contributed to finance the development of the assets (being a notional interest tax deduction allowed by Cyprus tax provisions).

Qualifying Expenditure

“Qualifying expenditure” is defined as the total research and development costs suffered in any tax year wholly and exclusively for the development, improvement or creation of qualifying intangible assets and where costs are directly related to the qualifying intangible assets. Qualifying expenditures include the following:

- Wages and salaries;

- Direct costs;

- General expenses relevant to installations used for Research and Development;

- Expenses for supplies relating to Research and Development;

- Cost that have been outsourced to non-related persons for the purpose of Research and Development.

Excluded from the Qualifying expenditure are the following:

- Cost for the acquisition of intangible assets.

- Interest paid or payable.

- Costs in relation to the acquisition or construction of immovable property.

- Amounts paid or payable directly or indirectly to a related person to conduct research and development, irrespective of whether these amounts relate to a cost sharing agreement.

- Costs which are not directly connected to a qualifying tangible asset.

Uplift Expenditure

Uplift expenditure is included to the qualifying expenditure, which will be equal to the lower of:

- 30% of the qualifying expenditure.

- The total cost of acquiring the qualifying asset plus the cost of subcontracting to related parties of any research and development regarding the said qualifying asset.

Overall Expenditure

Overall expenditure is defined as the sum of:

- The qualifying expenditure.

- The total cost of acquiring the qualifying asset plus the cost of outsourcing to related parties of any research and development activities regarding the said qualifying asset suffered in any tax year.

Example:

Presume that a Cyprus IP company licenses its IP to other companies and in return receives an annual royalty income of EUR 800,000. The IP was acquired for EUR 200,000 and additional research and development cost was subcontracted to non-related party for EUR 100,000. It also has direct expenses of EUR 150,000. The expected annual tax for the Cyprus IP Company will be as follows:

- Royalty income: 800,000

- Direct deductible expenses: (150,000)

- Overall Income: 650,000

- Qualifying Expenditure: 100,000

- Uplift Expenditure – lower of EUR 30,000 and EUR 200,000: 30,000 650,000 X (100,000+30,000) / 300,000: 281,667 X 80% = 225,334

- Consequently, the amount of EUR 225,334 will be considered as non-taxable.

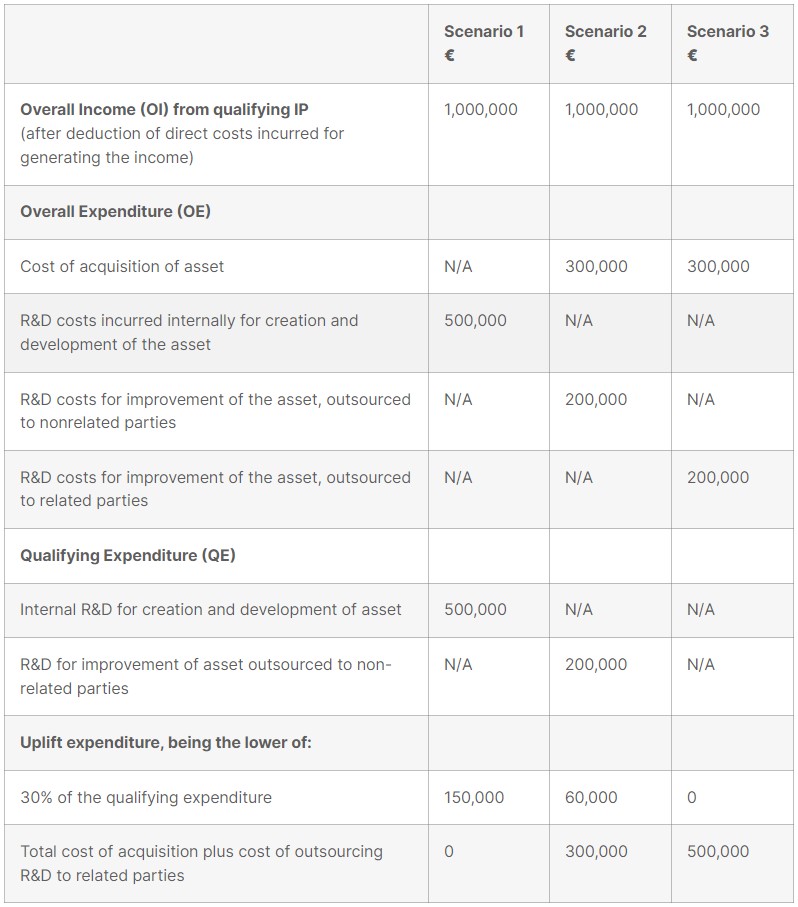

To put things in perspective, we set out some numerical examples illustrating how, under the new IP regime, one would reach the QP stage on which 80% notional deduction would be applied. For the purposes of the examples, it is assumed that the qualifying intangible asset was acquired/developed after 30 June 2016, thus it qualifies for the new IP regime. The variable factors in the examples are: (a) whether the asset was internally developed or whether it was acquired, and (b) whether subsequent R&D costs were outsourced to related parties or to third parties.

The Scenarios to be examined are as follows:

- The asset was created/developed/improved internally, with R&D costs being undertaken by the company itself.

- The asset was acquired, with subsequent R&D costs for improvements of the asset being were outsourced to non-related parties.

- The asset was acquired, with subsequent R&D costs for improvements being outsourced to related parties.

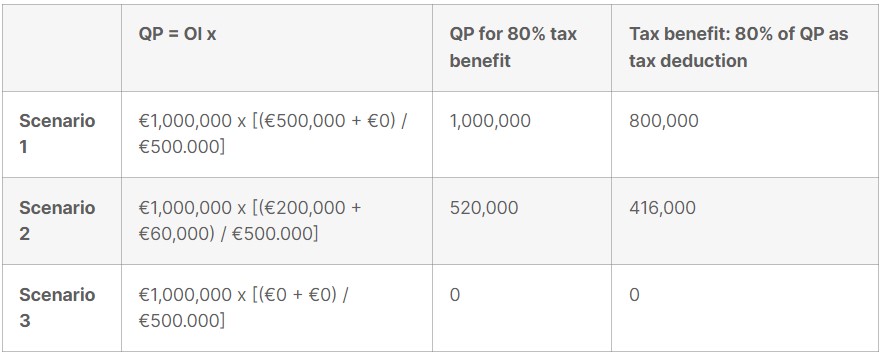

Applying the above figures to the formula for calculation of the qualifying profit (QP) and the tax benefit of up to 80% as a notional deduction, we have:

From the above analysis it is apparent that in scenario 1, the entire amount of the overall income is considered to be qualifying profit, due to the fact that the development of the asset was carried out internally, and so were the subsequent R&D costs for improvement of the asset (it is noted that if the R&D costs were subcontracted to a third party, they would still have qualified). On the other hand, in scenario 2 (asset acquired) the amount of qualified profit is significantly lower, and in the case of scenario 3 (asset acquired and R&D costs outsourced to related parties), none of the profit qualifies for the regime.

Note: The above information is not intended to constitute legal advise and/or tax advise and is provided for general purposes only. The information provided by this publication is of general nature and therefore it cannot substitute proper professional advice which is always given after serious consideration of the merits of each case.

Explore the Benefits of the Cyprus IP Box Regime

Are you looking to optimize the tax efficiency of your intellectual property assets? Discover how the Cyprus IP box regime can benefit your business. Contact our expert advisors today for a detailed analysis tailored to your specific needs and to ensure you fully leverage the advantages of the Cyprus intellectual property box regime. Let us help you harness the full potential of your intellectual assets.

Elevate Your Business with Dedalos Corporate

Dedalos Corporate offers expert services to streamline your business operations and ensure growth — partner with us to transform challenges into opportunities.